It seems that not a week goes by without news of another casualty on the UK High Street. The perfect storm of high business rates, lack of consumer confidence and the exponential growth of eCommerce has this year already seen the likes of Toys R Us and House of Fraser fall into administration, whilst Marks & Spencer, Mothercare and Debenhams have all announced significant programmes of store closures. The Chancellor’s recently announced reforms to business rates may offer some relief to smaller retailers, but for large High Street retail chains the changes offer little additional comfort.

The risk of further High Street failures and more retailers entering into CVAs poses a serious threat to retail property owners – a threat starkly illustrated in October this year when the Nicholson Shopping Centre in Maidenhead went into receivership. According to retail analyst Nelson Blackley, from the National Retail Research Knowledge Exchange Centre, more than 200 shopping centres across the UK are now in danger of falling into administration as major anchor stores decline. Blackley points to the unexpected collapse of BHS two years ago, catching landlords off-guard and leaving large, empty units in around 200 shopping centres, with more than half of those empty units still not yet filled.

In this climate of declining rental income, falling values and potential store closures, retail property owners need to urgently forward plan to minimise the possible impact on their assets as much as possible. Despite the negative headlines, there are still plenty of opportunities for physical retail to prosper – it’s just a case of landlords thinking differently about the spaces they own. As more retailers seek to reduce the space they occupy and the rents they pay, carving up large retail floorplates into smaller, more flexible units is an immediate option for landlords looking to fill vacant space.

However, there are also opportunities to be had in converting or redeveloping existing assets into alternative uses. In fact, evidence seems to suggest that mixed-use schemes will not only add value to landlords’ assets, but could also be the key to town centre salvation. According to recommendations in the Grimsey Review 2 earlier this year, town centres could be reinvigorated by placing less focus on retail to underpin the High Street and instead focusing on alternatives such as housing, leisure, entertainment, education and commercial office space.

For landlords looking to adapt their assets for alternative uses there are, of course, many hurdles to be overcome – not least of which is the fact that many existing shopping centres, retail parks or town centre high streets weren’t conceived with future flexibility in mind. When department stores were designed 30 or 40 years ago, for instance, little thought was given to their future adaptability, as it was probably believed that the like of House of Fraser or British Homes Stores would be there forever. Architects looking to remodel these assets into something fit for modern purpose are faced with a number of challenges: department stores are often self-contained units with footprints and orientations that do not lend themselves to easy reconfiguration; they often have deep footprints with small frontages limiting the opportunities for sub-division into sensible units; large inactive façades create dead areas within a town centre or shopping centre context and they are often well integrated into town centres or shopping centres meaning reconfiguration can impact on other essential infrastructure.

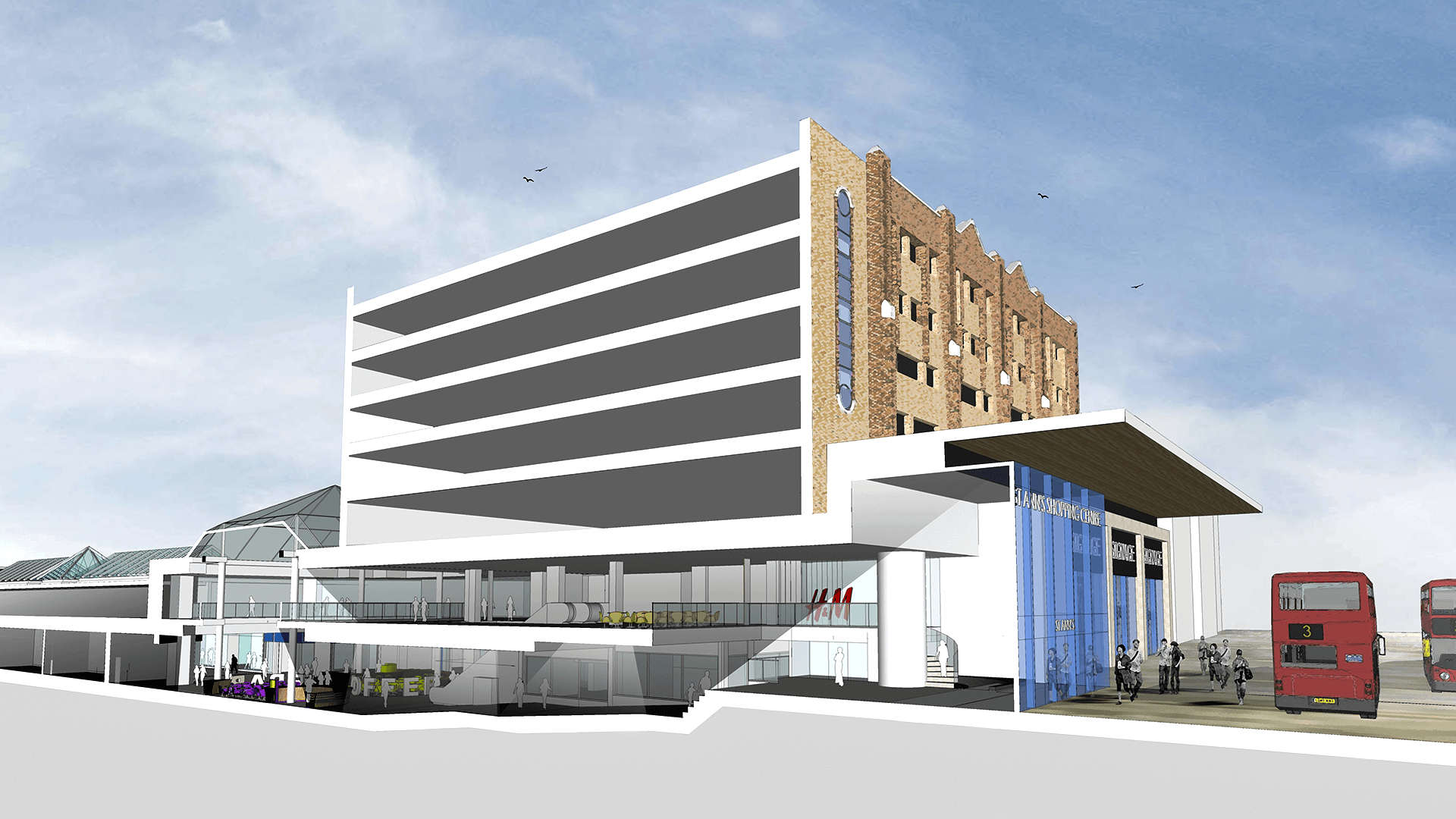

Whilst challenging, none of these issues are insurmountable; it just takes experience and good technical know-how to make the appropriate decisions for each individual scheme, balancing tenant needs against costs to landlords. At Urban Edge, we have been working with forward-thinking owners and developers to adapt their existing assets for a good number of years. A good example of ‘repurposing the High Street’ can be seen at Highcross in Leicester where, following the closure of the House of Fraser store in July 2017, we worked with Hammerson to develop proposals for the sub-division and remodelling of the vacated four-storey retail unit.

Our scheme has reconfigured the existing floor space into a mix of retail, leisure and food and drink units. Internally a new large-format retail unit was created for existing centre occupier Zara to relocate into, whilst lower ground floorspace was used to increase JD Sports’ existing unit to just over double its size. Meanwhile, new outward-looking food and drink units reactivate the Shires Lane and High Street façades.

A great example of how lateral thinking can maximise a client’s asset can be seen on the upper floor of the building. This was initially considered to be ‘dead space’ as there was no retail tenant demand for this floorspace, it lacked connectivity to the mall for leisure use, and was deemed unsuitable for office or hotel use due to its deep floorplates. It was, however, connected to the existing car park and our recommendation was to extend the car park into it, immediately adding value for the client who will be shortly benefiting from the additional income from those parking spaces, particularly during the busy periods.

Our design for Highcross also strengthens the link between the centre’s busy St Peter’s Square and Leicester’s High Street, with users drawn between the two by the architecture and activity created by new offers. The new façade units take references from the centre’s existing architecture and materials, maximising visibility into the shopfronts.

Our experience on this and other such projects, has now led us to examine similar schemes for clients and look at repurposing existing units for other complementary uses such as offices or hotels. In some instances, we are also exploring air rights developments, building on top of existing assets such as department stores or car parks to accommodate offices or residential. We are also working with clients and local authority planners to change policy and help promote the future of high streets and shopping centres.

It is clear that recent years have seen a revolution in the way that we shop – and those changes will continue to impact the retail property sector for the foreseeable future. Given the pace of change and the threats posed to retail centres by CVAs and major store closures, quick decisions are now required by landlords on how best to re-purpose their assets and design in future flexibility to weather the choppy waters of the retail environment. Our experience working with forward-planning and open-thinking clients tells us that the threats posed can be mitigated and, importantly, new opportunities can be created. Cause, we think, for great optimism.

Darren Hodgson | Associate Director